This charge may be in enhancement to various other lending institution costs, or a round figure that covers all of their prices as well as commission. A rise in the impressive home mortgage balance when the monthly mortgage repayments do not cover all the passion due on the financing. The unsettled passion is included in the staying balance to produce "adverse" amortization. A variable rate mortgage will certainly change with the CIBC Prime price throughout the home loan term. While your routine payment will stay constant, your rates of interest may alter based upon market problems. This impacts the quantity of principal you pay off every month.

As you can see, the cost of a home mortgage factor can vary considerably based upon the car loan amount, so not all points are produced equivalent people. The home loan process can be rather difficult as well as tough to make sense of at times, what with all the insane terminology and also heaps of paperwork. The balance of a car loan, separate from passion or add-on fees. The difference between the worth of a residential or commercial property and also any type of car loans or cases outstanding. Equal Credit Scores Possibility Act is the regulation that stops discrimination during the process of providing credit history.

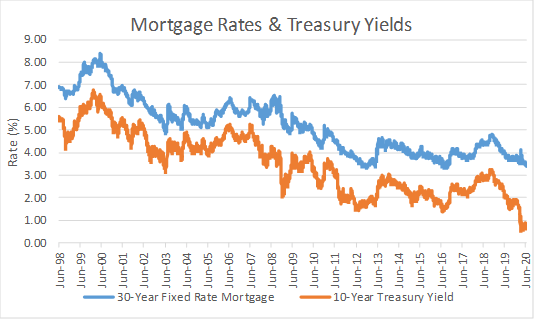

Typically, investors intend to see returns rising, as well as you'll often hear the modifications revealed in basis factors. Basis factors are typically used to reveal adjustments in the yields on company or government bonds dealt by capitalists. Yields change, partially because ofprevailing rates of interest, which are established by the Federal Reserve's Free market Board.

Each point you acquire expenses 1 percent of your overall financing quantity. Weekly, Zack's e-newsletter will certainly deal with subjects such as retirement, cost savings, loans, mortgages, tax obligation and investment strategies, and extra. Also moderate basis factor hikes can increase repayments as well as home loan insurance policy premiums. Financiers additionally refer to basis points when going over the expense of common funds and exchange-traded funds. Commonly, fund expenses are revealed as a yearly percentage of possessions. For example, the "Investor" share class of Vanguard Total amount Stock Market Index, the biggest supply shared fund, has costs of 0.17%, or 17 basis points.

- At 90% LTV, the average price moved up by 7 basis points, offering 4.04%.

- Home mortgage factors are tax-deductible in full in the year you pay them, or throughout the duration of your finance.

- At 90% LTV, the average price obtained 5 basis points, finishing the week at 2.55%, as well as, at 80% LTV, the average rate enhanced by 9 basis points to 2.41%.

- Don't go for the initial mortgage bundle that you come across.

- By comparison, one price cut factor amounts to 1% of the finance quantity.

Basis point walks take place when rates of interest go up as well as can have a significant impact on a mortgage's settlement. Basis points are a means people interact about adjustments in rates of interest, including those for home loans. It's also crucial to keep in mind that changes of a few basis points are more important to the lending institution than they ought to be to you as the borrower.

Get The Best Prices

Nevertheless, as noted in the post, depending upon the dimension of the funding, lenders may require to bill more or less to cover their prices and also generate income. Simply look for the most effective combination of points, price, as well as costs to guarantee you're obtaining the very best deal. A variable rate home mortgage commonly offers even more adaptable terms than a set rate home mortgage.

Accessibility On Basis Factor Mortgage Site

As opposed to considering your revenue, it looks at the residential or commercial property's revenue. If the interest rate rise suggests that the residential or commercial property no longer meets its financial obligation service insurance coverage proportion, it will either refute the funding or restrict its size. So, allow's claim you pay $2,000 for one price cut factor on a $200,000 funding. If you started with a rate of interest of 4.5%, purchasing a single factor usually brings the rate of interest down to 4.25%. In this case, the month-to-month home loan payment would certainly dip from $1,013.37 to $983.88.

Source charges are negotiable but they help a lending institution cover their fundamental expenses & alleviate the danger a consumer may pre-pay their home loan prior to the overhead is covered. On adhering home mortgages this fee generally runs somewhere between $750 to $,1200. Additionally note that not every bank as well as broker costs mortgage factors, so if you make the effort to look around, you might have the ability to prevent factors entirely while securing the most affordable home mortgage price feasible. This works in the exact opposite means as traditional mortgage factors because you obtain a higher price, yet instead of spending for it, the lending institution provides you cash to spend for your fees. Obviously, your month-to-month mortgage payment will be higher because of this.

As an example, a modification of one basis factor in the cost-of-living index would be best way to sell a timeshare for free equivalent to a rise or decrease in inflation of 0.01%. A basis factor represents the smallest system Visit the website of measurement for rate of interest as well as various other economic tools. One basis point amounts to one-hundredth of 1 percent, or.01. Basis factors are also described in the financial globe as BPS, "beeps," or points. Opinions shared below are writer's alone, not those of any financial institution, bank card issuer or various other company, as well as have not been reviewed, authorized or otherwise endorsed by any of these entities. All info, including rates as well as charges, are accurate as of the day of publication as well as are updated as supplied by our partners.

What Are Basis Factors And How You can find out more Do They Affect Your Home Mortgage?

On an interest rate of 6.15%, the 25-bps decrease would lead to a brand-new annual percentage rate of 5.90%. Basis points are made use of to determine numerous monetary tools, including the costs, spreads and prices in industrial real estate financing. Each basis factor deserves 0.01 percent of a solitary portion factor. Therefore, if the charges for a funding are 100 basis points, they represent 1 percent of the industrial home mortgage amount.