That didn't occur, as well as the memory of the outcome has actually stayed clear. Interest-only ARMs and alternative ARMs are various other methods homebuyers can start out with low repayments however wind up with much greater settlements in the future. You've reached take note of modifications in the fed funds rate as well as temporary Treasury expense yields, because LIBOR normally transforms in lockstep with it. An adjustable-rate mortgage is a finance that bases its rate of interest on an index, which is typically the LIBOR rate, the fed funds price, or the 1 year Treasury bill. An ARM is likewise known as an "adjustable-rate car loan," "variable-rate home mortgage," or "variable-rate car loan." Nevertheless, there are some sorts of car loans that she would suggest property buyers stay clear of.

If prices climb, the expense will be higher; if prices decrease, price will be reduced. In effect, the consumer has accepted take the rate of interest danger. The minimal payment on an Alternative ARM can leap drastically if its overdue major equilibrium hits the optimum limitation on unfavorable amortization (normally 110% to 125% of the initial funding quantity). If that happens, the following minimum month-to-month payment will be at a level that would fully amortize the ARM over its staying term.

- They usually give customers 5 to ten years before prices readjust for the first time.

- As an example, a 2/2/5 cap structure may sometimes be written simply 2/5.

- They then skipped en masse when their initially low mortgage repayments suddenly expanded also pricey.

- Nonetheless, you're still running the risk that interest rates will have increased then.

- You might still get a lending even in your situation does not match our assumptions.

Adjustable prices move part of the interest rate danger from the lender to the consumer. They can be made use of where unforeseeable rates of interest make fixed price loans hard to get. The customer benefits if the interest rate drops but loses if the rate of interest increases.

Your Repayments Could Lower

ARMs that permit unfavorable amortization will typically have repayment modifications that take place much less often than the interest rate modification. As an example, the rates of interest may be readjusted monthly, but the payment quantity only when every 12 months. This is the length of time that the rate of interest or funding duration on an ARM is scheduled to continue to be the same. The rate is reset at the end of this duration, and the monthly financing repayment is recalculated. Lazerson noted that whether a consumer chooses a standard set rate funding cheap timeshare for sale or ARM car loan, with rates of interest rising and rising cost of living high, individuals should be conservative with their cash. For Ronquillo, her clients with ARM loans are banking on lower settlements throughout the introductory period as well as refinancing from it before the rate matures.

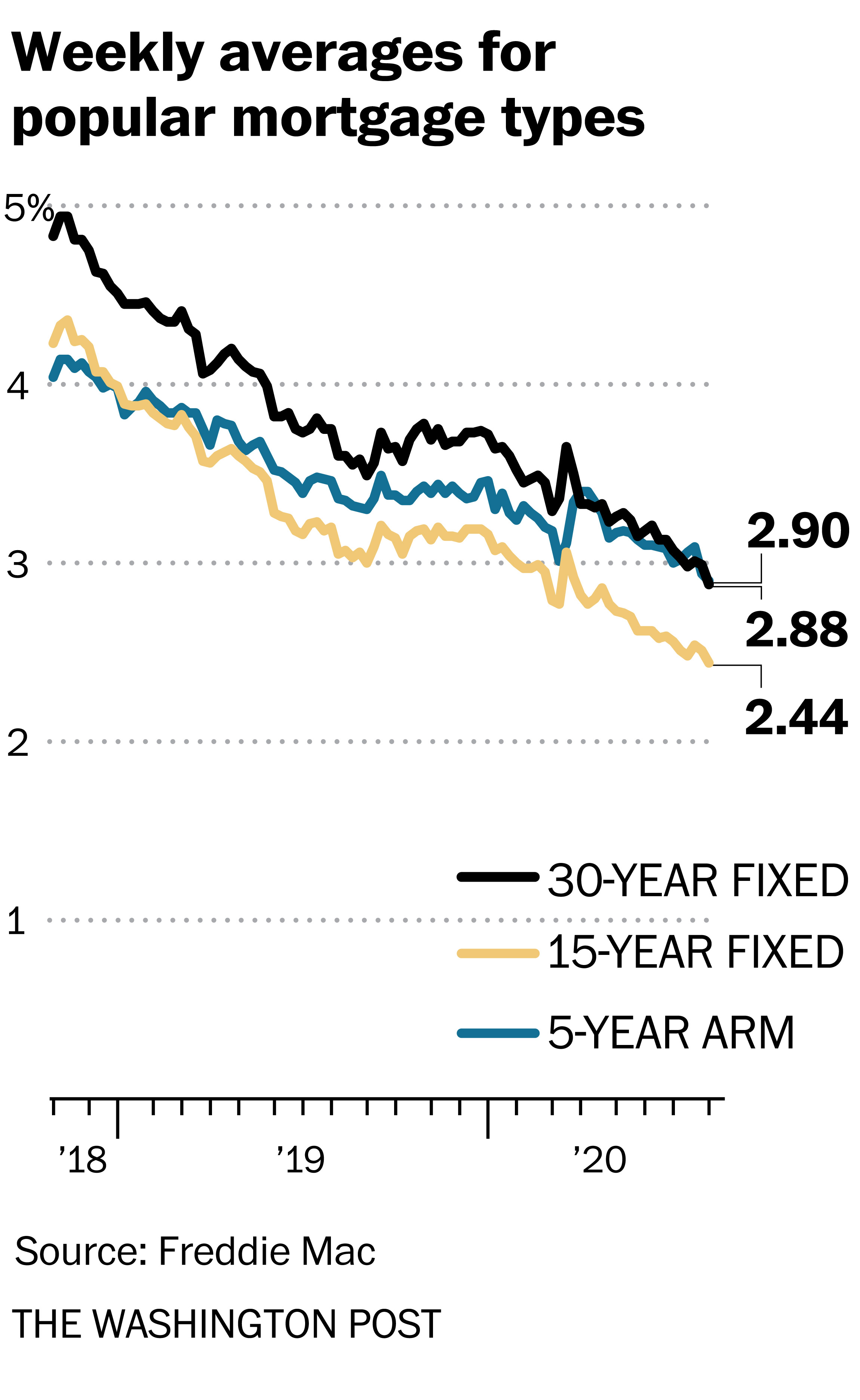

Key Mortgage Market Survey

The 5/1 hybrid ARM is an adjustable-rate mortgage with a preliminary five-year fixed rates of interest, after which the rate of interest changes every https://timebusinessnews.com/you-can-cancel-a-timeshare-permanently/ twelve month according to an index plus a margin. It could be a lot more listings on the market, or maybe just be afraid that rates of interest will relocate also higher, however property buyers are revealing more demand for mortgages. They are, nevertheless, transforming much more to variable-rate mortgages, which use lower rates. That provides a benefit as both rates and home rates remain to climb.

If you are disciplined concerning making these payments, you can really pay much more versus the concept. By doing this, you will acquire higher equity in the house than with a traditional home mortgage. These fundings threaten if you aren't planned for the change or the balloon repayment. They likewise have just the same disadvantages of any type of variable-rate mortgage. Your monthly payment just goes toward rate of interest, as well as not any of the concept, for the first three to 5 years.

There are a few circumstances where an ARM funding can make sense over a conventional, fixed-rate home mortgage. As an example, an ARM car loan might be more helpful if you're not planning on staying in your residence for more than five to one decade or you can pay for to repay your home loan before the rate adjustments. Additionally, those aiming to obtain a big lending may take advantage of an ARM finance due to the fact that the difference in between fixed and also adjustable rate tends to be bigger. This happens whenever the monthly home loan repayments are not big sufficient to pay all the interest due on the mortgage. This may be caused when the payment cap included in the ARM is reduced sufficient such that the principal plus interest payment is more than the settlement cap.

As an example, if you prepare to market the home prior to the rates of interest begins to adjust, those prospective changes may not be an issue for your spending plan. Consequently, the price as well as settlement results you see from this calculator may not reflect your real circumstance. You might still qualify for a financing also in your scenario doesn't match our presumptions.

My Lender Talks About Basis Factors What Are They, And Exactly How Do They Relate To Arms?

The size of the average fixed-rate home mortgage last week across the country was $280,900. The size of the ordinary adjustable-rate mortgage was $688,400-- two and also a half times as large. Adjustment regularity describes the price at which a variable-rate mortgage price is changed as soon as the preliminary period has actually ended. An additional circumstance in which an ARM would certainly make sense is if you can pay for to increase the https://geekinsider.com/the-problem-with-timeshares-and-how-primeshare-differentiates/ repayments every month by adequate to pay it off prior to it resets.

If market conditions alter and also there's even more of a difference between flexible prices and fixed-rate home loans, the lower price on an ARM can assist give you monetary versatility. In addition, as we saw earlier, you can pay for a fair bit of principal by taking the payment financial savings in the preliminary years and putting it back toward the balance. Flexible price home loans, like various other sorts of home mortgage, typically enable the debtor to prepay major early scot-free. Early repayments of component of the principal will reduce the overall price of the car loan, however will certainly not reduce the quantity of time required to settle the finance like other lending types.